Quick start

Integrate DeFi yield in your application

Kiln DeFi was build to enable wallets, custodians, exchanges, or fintech platform to simplify access to yield. Integrate DeFi via our fullstack offering combining smart contract, APIs and UI components. Via Kiln DeFi users can seamlessly deposit stablecoins into lending strategies like Aave, Compound, or Morpho, and earn interest from borrower activity. You control the experience — including how you monetize it (e.g., deposit fees, rewards fees, etc.).

🔧 Integration scope

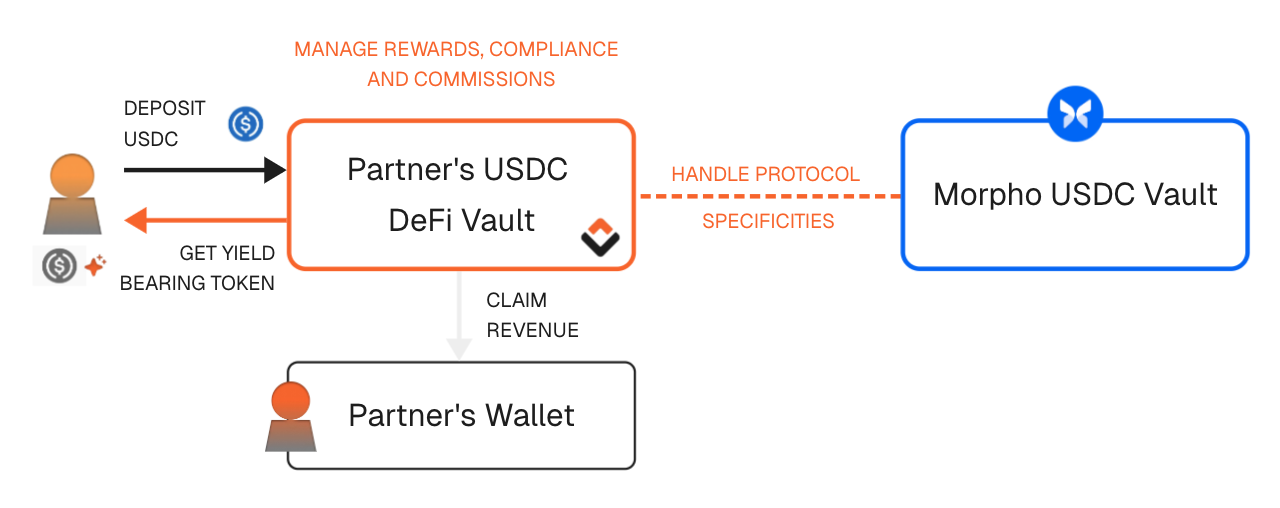

Abstract away DeFi integration and monetization complexity with Kiln DeFi Vaults — created by seasoned smart contract engineers and audited by the best in the industry.

Kiln DeFi Vaults expose a single, ERC-4626-compliant interface to multiple underlying DeFi protocols, with native support for fee handling, on-chain accounting, and compliance.

Here’s what you gain by building your product with Kiln DeFi:

- On-chain fee management & accounting: Vaults automatically handle user rewards and protocol yields while applying partner-defined service fees. All accounting logic is transparently executed on-chain.

- Protocol-agnostic integration via ERC-4626 Vaults: Each Vault conforms to the ERC-4626 standard, enabling a unified interface across diverse DeFi strategies. Integrate once, support many.

- Compliant by design: Vaults enforce OFAC address screening, blocklists, and API & Widget enable optional geofencing — enabling region-specific controls without additional backend logic.

- Customizable incentives & monetization logic: Partners can define additional reward management logic, monetization strategies, or other incentive structures — all enforced at the contract level and fully auditable.

➡️ View full list of supported protocols.

Protocol selections and deploymentKiln DeFi is designed for flexibility — you can connect to a wide range of protocols, and our team is here to help you choose the ones that best fit your needs. Meanwhile, your engineering team can begin integrating Kiln DeFi on testnet, even if decisions around protocols, fee structures, compliance, or reward management are still in progress.

⚙️ Integration overview

The integration typically takes < 1 week and follows these 4 simple phases:

| Phase | Description |

|---|---|

| 1. Discovery | Use existing testnet vaults to explore Kiln DeFi and use contracts and API day one. |

| 2. Integrate reporting | Integrate Kiln Connect APIs to fetch vault metadata and user position data. |

| 3. Vaults interactions | Implement deposit/withdraw flows via smart contract calls, API Tx crafting or use Kiln Widget. |

| 4. QA & Launch | Test, validate with Kiln's team, deploy the mainnet vaults then go live. |

Stay in contact with Kiln's teamYou'll get a dedicated Slack or Telegram channel with the Kiln team for questions, reviews, and support throughout the process.

🧪 Discovery: Morpho USDC Vault

Want to see how a user deposits into a Morpho vault and earns yield?

→ Head to our integration guide or try out a live test vault or use the widget bellow to explore Kiln DeFi.

📘 Learn More

For additional information about the product like vault mechanics, reward distribution options, roles, risk, security and more:

→ Visit docs.kiln.fi/v1/kiln-products/defi

Updated 6 months ago

You are fully up to speed how Kiln DeFi work, you can now start your integration right now.